Latin America

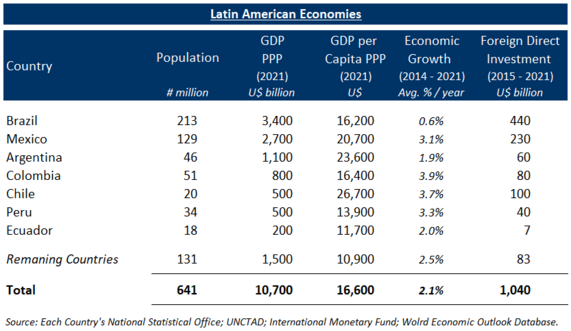

Latin America, with a GDP of approx. U$ 10,000 billion and a population of approx. 660 million, has proven to be a very attractive region for global multinationals, having solid economic growth: 2.1% p.a. in the last 5 years, as well as a high potential for future growth.

The vast majority of Latin American countries, including Mexico and Peru, have achieved a process of rapid economic liberalization which has set the platform for sustained growth. This has positioned the region as particularly attractive.

Latin America's economic integration is growing as a result of a number of trade treaties among neighboring countries as well, as the United States and Europe. These include treaties such as USMCA, CAFTA, Mercosur, Caricom, among others.

Foreign Direct Investment in the region continues to be encouraging. In 2021 it reached U$ 134 billion, for a total of approx. U$ 1,000 billion in the past 7 years.

As a result, M&A transactions have grown in importance, driven by global multinationals and fast growing regional groups acquiring numerous family-owned companies with limited institutional management, yet with important share of market in their countries.

During 2021 over 1,200 M&A transactions were reported, equivalent to approx. U$ 85-90 billion, the most important being Brazil, Chile, and Mexico. In addition, Colombia and Peru have rapidly grown in relevance.

Our firm, having extensive experience in cross-border M&A transactions in Latin America and with on-site local team presence in Mexico, Central America, and Peru, is ideally positioned to assist global multinationals, regional groups, and family-owned companies in designing and executing their corporate development projects.